Are you bogged down by credit card debt? Did you spend a little too much last year? Maybe the last five or ten years? Are you sick and tired of the chains and shackles of your debt? It’s not magic paying off credit cards. Or debt for that matter. It takes discipline and sacrifice. But most importantly, a plan. If you’re married, it takes effort and teamwork by both. Now, this only works if you’re willing to stop adding to the debt! So, if you’re actually committed to this plan, get those credit cards out and cut them up! Toss them in the trash and have a celebration or make a toast to their departure from your life. So, if you’re ready to tackle your debt and get rid of your credit cards, here goes!

𝙷𝚘𝚠 𝚝𝚘 𝙿𝚊𝚢 𝙾𝚏𝚏 𝚈𝚘𝚞𝚛 𝙲𝚛𝚎𝚍𝚒𝚝 𝙲𝚊𝚛𝚍𝚜 𝚒𝚗 𝟸0𝟸𝟹

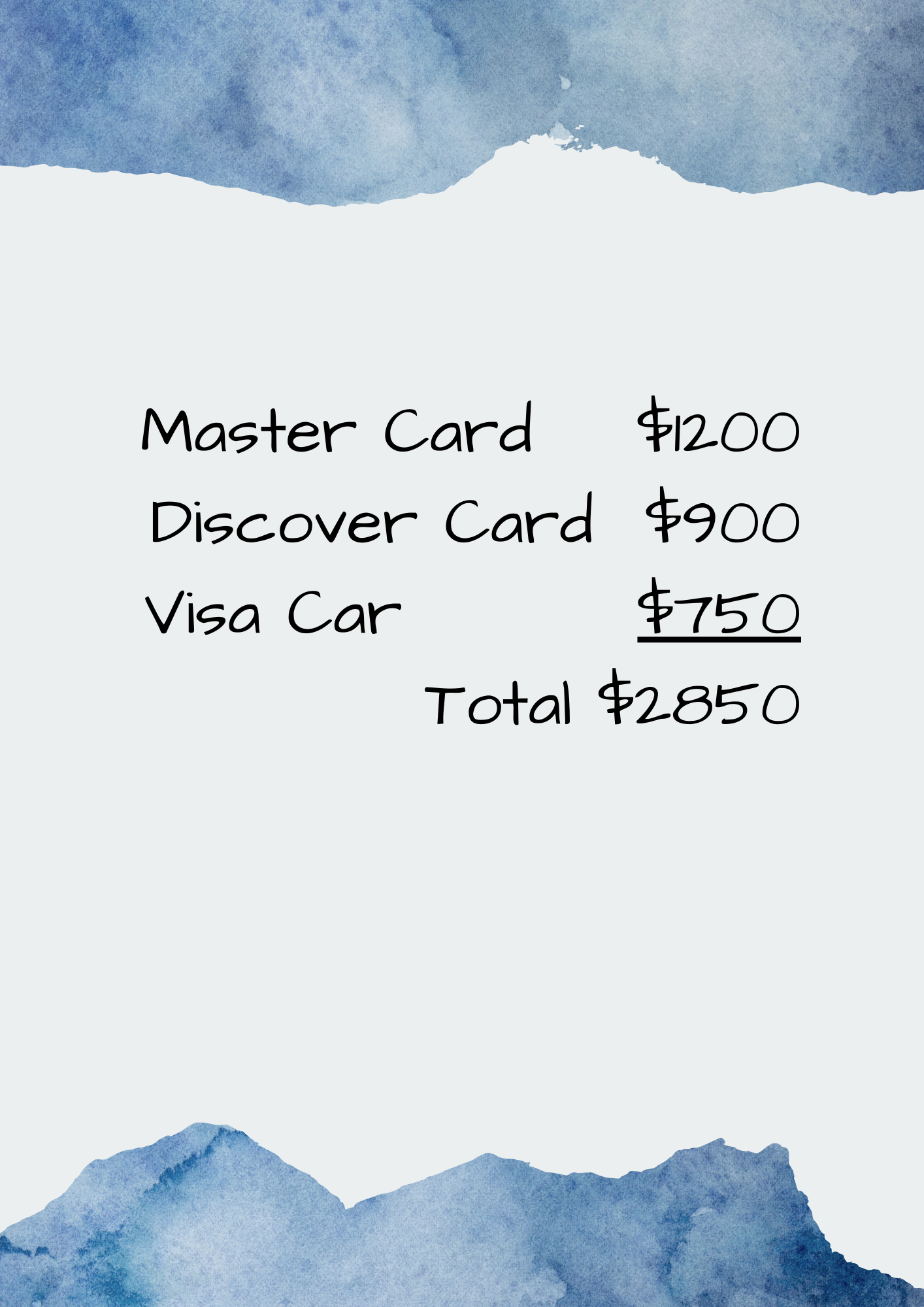

𝟏 – 𝐓𝐨𝐭𝐚𝐥 𝐭𝐡𝐞 𝐁𝐚𝐥𝐚𝐧𝐜𝐞

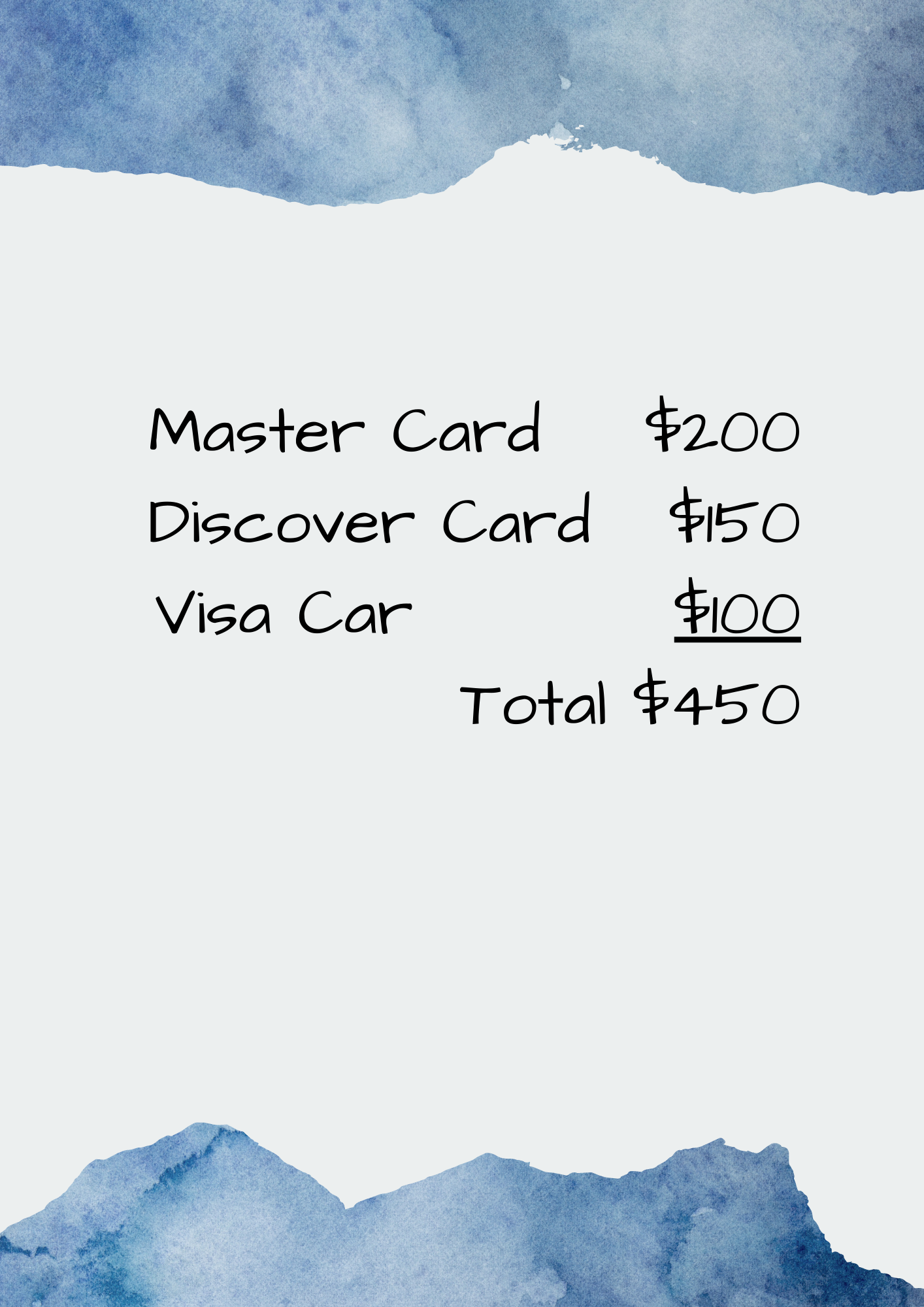

Let’s go back to simple math. Fifth grade? Sixth grade? Let’s simply add up all of our credit card balances. Get out your phone calculator and add them up. Pennies and all! Here’s an example:

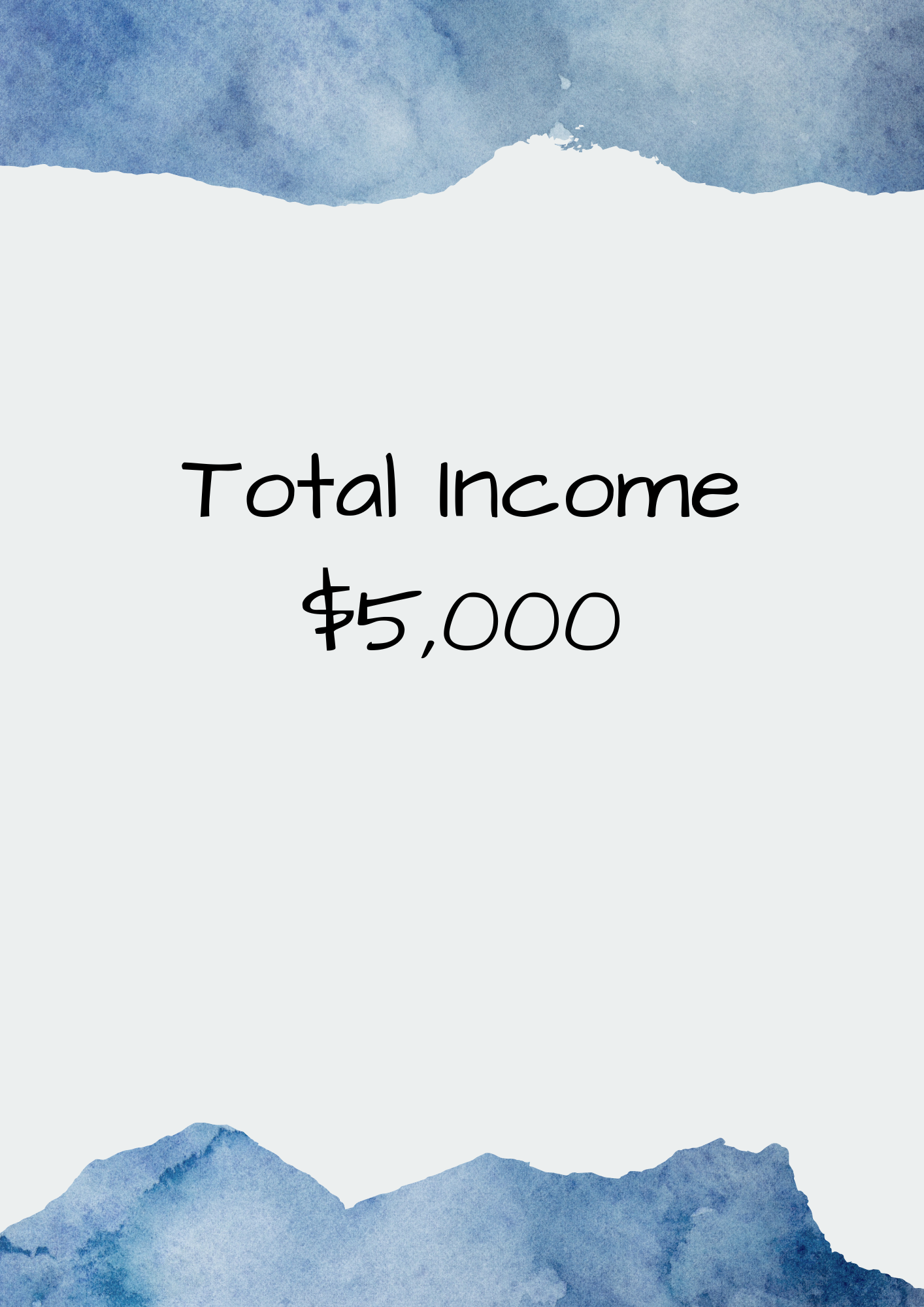

𝟐- 𝐊𝐧𝐨𝐰 𝐇𝐨𝐰 𝐌𝐮𝐜𝐡 𝐘𝐨𝐮 𝐂𝐚𝐧 𝐏𝐚𝐲 𝐌𝐨𝐧𝐭𝐡𝐥𝐲

This is also called your Total Monthly Income. Whatever is guaranteed for you to receive in payment for working, child support, your spouses income (because, you two are working as a TEAM, right?) Don’t complicate this question. How much money are you expecting to make this month? If you are unsure or your income is a little up and down, checkout your last three months. Add them together, then divide by 3. This we will use as your Average Monthly Income. Some months maybe less, some maybe more. But hopefully you work steady enough that you get pretty close. If your income is unstable, that’s a career conversation for later. Here’s an example we will use for this illustration:

Now determine from your Total Monthly Income how much you have left over. After you have paid house, clothes, insurance, gas, transportation. (This is where you may start analyzing some of the monthly bills you owe on that are luxuries and wants over necessities, and eliminating some). How much is left over? BEFORE you start paying on your credit cards. Let’s say for our example, you have $1,000 left over. We’ll use this number in step 4.

Check out Episode #6 – How to Create a Budget

𝟑 – 𝐏𝐚𝐲 𝐭𝐡𝐞 𝐌𝐢𝐧𝐢𝐦𝐮𝐦 𝐨𝐧 𝐄𝐚𝐜𝐡

Very simple next step, you do NOT stop paying on any of them. Let me make that clear. Keep each payment current. No getting behind. No skipping out on paying one card to pay another (unless an extreme situation arose, which I am not getting into in this post).

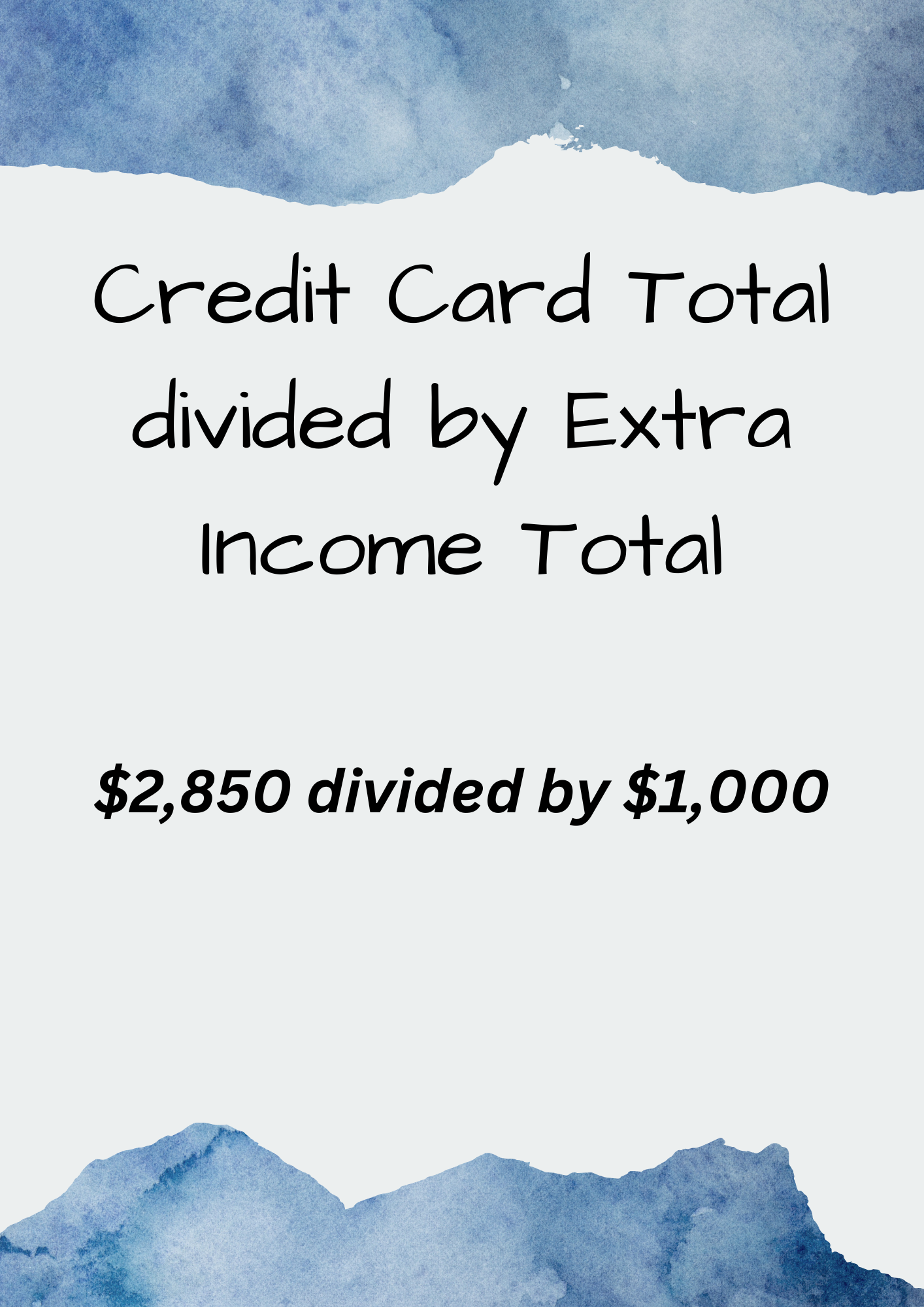

After you have set up to pay the minimum on each, I want you to take the total amount of credit card debt you owe and divide it by the total amount of extra income you can afford to pay each month. From our example that was $1,000.

In this example it would take you less than 3 months to pay off this debt. Did you feel that? That weight off your shoulders? That relief? That breath of fresh air? A mountain of credit card debt. $2,850 in a moment became only a 3 month task to complete.

Did you feel that? That weight off your shoulders? That relief? That breath of fresh air?

Now, how do you do that?

𝟒 – 𝐏𝐚𝐲 𝐄𝐱𝐭𝐫𝐚 𝐨𝐧 𝐎𝐧𝐞

Now let’s total the monthly payments of your credit cards. Let’s pretend this below:

Need more income? Check out episode 7, part 1 and 2 $1,000 Emergency Fund in 30 Days (30 Ideas for Creating an Income) to learn simple ways to increase your income.

A total of $450 (I’m making this up) and you can pay $1,000 each month toward credit cards. Choose a card that you wish to pay off first. Let’s pretend it’s the Discover. You’ll pay $200 toward your Master card and $100 toward your Visa. And that leaves? $1,000 – ($200 + $100)? Or $1,000-$300? That’s right, $700 ($150 for the Discover plus the extra $550) that goes ALL toward your Discover card. Which, according to my calculations will be paid off using this method in barely over one month.

And once that ones paid off? Take that total amount again $700 and pay it ALL toward your next card – let’s say the Visa. Which is a total of $800. And if my math is correct again would be paid off in one month with some left over. And you guessed it, the third month, EVERYTHING goes toward the final card.

Now, I understand, credit cards have interest rates, so this basic math may take a little longer. Or, if you follow the next step, it may even be paid off quicker.

𝟓 – 𝐖𝐡𝐚𝐭 𝐈𝐟 𝐘𝐨𝐮 𝐃𝐨𝐧’𝐭 𝐌𝐚𝐤𝐞 𝐄𝐧𝐨𝐮𝐠𝐡?

The question of all questions. What if I have made SUCH a mess that I don’t have enough at the end of the month to pay any extra? Or, along with step 4, what if I want to pay it off a little faster?

Two options my friends:

- Work more

- Eliminate some bills from your budget sheet (cable, internet, scale back on your cell phone plan, postpone kid’s extracurricular activities for a period of time)

It’s amazing the sacrifices we begin to make once we see this big picture.

𝑺𝒖𝒎𝒎𝒂𝒓𝒚

As I always say at the end of each one of my podcast episodes – Success by 1,000 Wins, I believe in you. Someone in your life…believes in you. At first this may all seem SO overwhelming. I hope that perhaps this step-by-step guide relieved some of that anxiety and tension. Perhaps some of you just needed to see the big picture. Maybe you just needed an outline or plan of attack. I hope this helps bless your family so you can live to be outrageously wealthy and become outrageously generous in your life!

Photo Credit: Photo by Angelo Pantazis on Unsplash

𝙸𝚏 𝚈𝚘𝚞 𝙴𝚗𝚓𝚘𝚢𝚎𝚍 𝚝𝚑𝚒𝚜 𝙱𝚎 𝚂𝚞𝚛𝚎 𝚝𝚘 𝙲𝚑𝚎𝚌𝚔 𝙾𝚞𝚝 𝚃𝚑𝚎𝚜𝚎:

Episode #10 – Why Credit Cards Are the Worst

Episode #8 – Marriage and Money, 9 Questions Teammates Ask During a Budget Meeting

ABOUT THE AUTHOR

Michael Kopans is here to share ideas for helping 1 million people reach a million dollar net worth by using money principles he’s learned over the years. Let’s talk money, budgets, becoming debt free, financial wisdom, financial principles that work.

money, budget, marriage, biblical wisdom

Leave a comment